The introduction of digital banking has made it easier List of diplomatic missions of the United Arab Emirates than ever to open an account from the consolation of your home and even just from the respective cellular banking app. It entails gathering needed paperwork, comparing different bank accounts, and making use of by way of the bank’s web site. You can open a checking account on-line within the UK if you select an expat account with a excessive minimum steadiness, or if you’re already a UK resident with a biometric residence card. HSBC Expat present accounts are provided in GBP, USD and EUR, with financial savings accounts obtainable in 19 currencies. Nevertheless, fairly excessive minimal balance requirements apply which could be a barrier.

International Money Transfers In The Uk

If you’re applying for a full UK enterprise checking account, you should contact your chosen bank’s central inward investment staff. Newer banks corresponding to Monzo, Starling, and Revolut function primarily online or via apps. They usually have user-friendly options like prompt spending notifications, financial savings pots, and no fees for spending abroad. The UK has a wide selection of banks and account providers, from high-street names to online-only “challenger” banks.

Evaluating your options can help you discover the most effective fit in your needs. If you’re in larger schooling or have graduated inside the past few years, pupil or graduate accounts might provide interest-free overdrafts and incentives like railcards or discounted services. There’s no authorized barrier to non-residents and new arrivals within the UK opening a bank account https://execdubai.com/.

What Paperwork Do You Need To Open A Checking Account Online?

- Digital financial institution Chase has been named a WRP for the first time this year with a string of four and five star scores, and 1% cashback for a 12 months.

- That mentioned, some UK banks could have further circumstances and should (or may not) settle for “alternative” documents depending in your client profile.

- You use the knowledge at your individual risk, for more particulars learn how our website works.

- In most circumstances, you’ll obtain a choice inside a few working days for standard accounts.

- Take 5 minutes to inform us should you discovered what you wanted on our web site.Your feedback will help us give tens of millions of individuals the knowledge they want.

Cell banking is available via the HSBC app which could be downloaded from the website. Current accounts provide a flexible and versatile choice for on a daily basis banking. They provide a range of features, including overdrafts, rewards, and on-line banking.

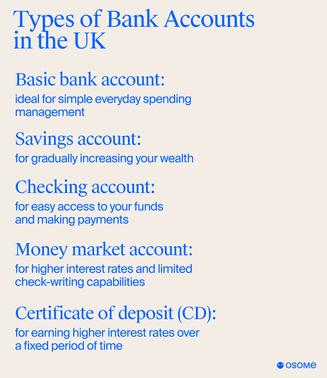

Some cost a monthly fee and also you might be requested to deposit a large sum of cash. Non-residents and foreigners in the UK can choose between a variety of account types relying on their preferences and priorities. Current accounts supply extra flexibility than savings accounts since you’ll be able to easily transfer cash between them. They additionally include handy options similar to debit playing cards, online banking, and bill pay services that make managing your finances simpler.

Sensible Account

Skilled advisors won’t only gather and put together all of the required documents but additionally offer you some advice as to one of the best strategy throughout your appointment with a financial institution manager. After activation, you should have the power to access your account online, through Opening a Bank Account In The UK cellular banking apps or make transactions at ATMs or branches. Interest earned on these accounts might help you build wealth over time, although they often include charges or minimal deposit requirements. The idea is to save cash for main purchases or emergencies, so that you won’t need frequent entry.

An overdraft is a type of credit score so present accounts with overdrafts will seem on your credit report and successive functions in a short space of time might negatively affect your score. There’s a extensive variety of UK business financial institution accounts obtainable, with various companies and pricing constructions, so you want to be capable of discover a proposal that matches your company’s needs. Sure, but your options may be https://preciousjewelery.com/?p=608 restricted to opening an expat account which needs a deposit within the area of 50,000 GBP to open. This is a non-bank possibility which may be opened from many countries and regions all over the world, and used to carry and exchange 40+ currencies simply.